Real Estate Equity Investment: Comprehensive Guide to Building Wealth Through Property Ownership

Real estate equity investment is one of the most powerful ways individuals and institutions build wealth over time. Unlike debt financing, which focuses on borrowing capital to purchase property, equity investment emphasizes ownership stakes in real estate assets. This ownership allows investors to benefit from appreciation, rental income, and various tax advantages.

Equity in real estate represents the portion of the property that an investor truly owns, free of debt obligations. For example, if a property is worth $1 million and the outstanding mortgage is $600,000, the equity amounts to $400,000. This concept is the cornerstone of wealth-building in the property market.

Understanding the Core of Real Estate Equity Investment

Equity investment in real estate revolves around building long-term ownership value. By gradually increasing equity, investors enhance their net worth while simultaneously reducing exposure to financial risk.

Equity grows through two main channels: paying down mortgage debt and property appreciation. When combined, these factors generate powerful compounding returns, making real estate one of the most attractive asset classes for both institutional and private investors.

Key Benefits of Real Estate Equity Investment

Long-Term Wealth Creation

Real estate equity investment allows investors to create sustainable wealth through asset appreciation. Properties in prime locations tend to increase in value over time, offering not only capital growth but also additional equity leverage for future investments.

Additionally, real estate is a tangible asset that provides security compared to more volatile investments such as stocks or cryptocurrencies. This makes equity investment especially appealing to investors seeking stability and predictable long-term returns.

Passive Income Generation

One of the biggest advantages of equity investment is rental income. Property owners can generate consistent cash flow while simultaneously growing their equity base. This dual benefit enhances financial resilience and creates a pathway to financial independence.

Technology’s Role in Equity Investment

Advancements in technology have transformed how investors engage with real estate equity opportunities. Online platforms and data-driven analytics have made it easier to evaluate deals, monitor property performance, and manage portfolios efficiently.

Investors now leverage property technology (PropTech) tools to estimate property valuations, forecast rental yields, and assess long-term equity growth potential. These digital innovations significantly reduce risk while enhancing decision-making for both seasoned and new investors.

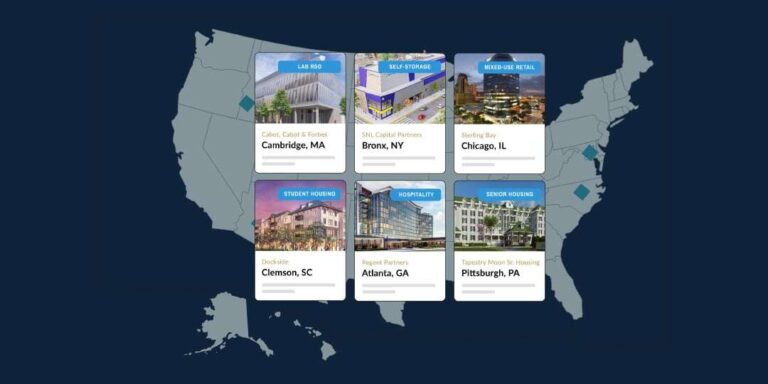

Real-World Examples of Real Estate Equity Investment

Equity Growth Through Residential Property

Consider an investor purchasing a residential property worth $500,000 with a down payment of $100,000. Over ten years, the property appreciates to $700,000 while the mortgage balance reduces to $300,000. The investor’s equity grows from $100,000 to $400,000, a fourfold increase in ownership value.

This scenario demonstrates how equity compounds through debt repayment and appreciation, illustrating why residential properties remain a core equity investment strategy.

Institutional Real Estate Equity Funds

Institutional investors often pool resources into equity funds that acquire large-scale commercial properties. These funds distribute ownership shares among multiple investors, reducing individual risk while providing exposure to lucrative real estate markets.

For instance, a real estate equity fund may purchase an office building, generating rental income and long-term appreciation. Investors benefit proportionally based on their ownership stakes, showcasing how equity investment scales to institutional levels.

Mixed-Use Property Equity Strategy

Another practical example involves mixed-use developments that combine residential, retail, and office spaces. Investors in such projects benefit from diverse income streams while building equity in multi-purpose assets.

The long-term equity growth in mixed-use properties often surpasses that of single-use assets due to diversified demand and higher resilience against market fluctuations. This makes them highly attractive for sophisticated equity investors seeking both stability and growth.

Real Estate Investment Trusts (REITs) and Equity Positions

REITs provide a simplified path for investors to access equity stakes in large property portfolios. Unlike direct ownership, REIT investors purchase shares of companies that own and manage real estate assets.

Equity investment in REITs provides liquidity, diversification, and passive income through dividends. While not identical to direct ownership, they serve as an accessible entry point for individuals interested in building real estate equity exposure.

Use Cases of Real Estate Equity Investment

Building Retirement Wealth

Many individuals rely on real estate equity as a core part of their retirement strategy. By paying down property debt during working years, investors can retire with mortgage-free properties that generate stable income.

This approach ensures long-term financial security, as the equity-rich asset provides both income and an appreciating safety net.

Institutional Portfolio Diversification

Institutions like pension funds and insurance companies often use equity investments in real estate to diversify their portfolios. Real estate provides low correlation with traditional equities and bonds, reducing overall risk while enhancing returns.

By holding equity stakes in commercial or residential properties, institutions ensure both income stability and long-term capital growth.

Family Wealth Transfer

Real estate equity is also a powerful tool for intergenerational wealth transfer. Families can pass down properties with accumulated equity, ensuring financial security for future generations. This creates a lasting legacy that goes beyond monetary value.

Practical Advantages of Real Estate Equity Investment

Equity investments provide both short- and long-term advantages. In the short term, investors enjoy rental income and potential tax benefits. Over the long term, property appreciation compounds wealth and enhances borrowing capacity for additional investments.

Furthermore, equity investments allow for portfolio leverage. Investors can refinance properties to unlock equity, which can then be reinvested into new opportunities, creating a cycle of growth and expansion.

Frequently Asked Questions (FAQ)

1. What is the main difference between real estate equity investment and debt investment?

Equity investment involves owning a share of the property, benefiting from appreciation and income. Debt investment, on the other hand, involves lending money to property owners and earning interest without ownership rights.

2. Is real estate equity investment suitable for beginners?

Yes, beginners can start small by purchasing residential properties or investing in REITs. These options allow individuals to build equity over time while learning how the market operates.

3. How risky is real estate equity investment compared to other assets?

While real estate markets can fluctuate, equity investment generally carries lower risk than stocks due tothe property’s tangible value and long-term appreciation potential. Proper research and diversification help mitigate risks further.