Nuveen Real Estate: Global Investment Strategies, Benefits, and Insights

Nuveen Real Estate is one of the world’s largest investment managers, with a diversified portfolio that spans multiple continents, property sectors, and investment strategies. As part of TIAA (Teachers Insurance and Annuity Association of America), Nuveen has established itself as a leader in responsible investing, sustainability-focused strategies, and large-scale real estate management.

With over $150 billion in assets under management, Nuveen Real Estate not only serves institutional investors but also influences the global property landscape by aligning financial performance with broader societal and environmental goals. This article explores the depth of Nuveen Real Estate’s operations, its use of technology, real-world case studies, benefits, and practical use cases that show its impact on modern real estate investment.

What is Nuveen Real Estate?

Nuveen Real Estate is the real estate investment division of Nuveen, a global investment manager owned by TIAA. The firm provides access to a wide range of real estate strategies, including equity and debt investments across various property types such as office, industrial, residential, retail, and alternative sectors.

Their mission extends beyond delivering financial returns. They focus on integrating sustainability, innovation, and community impact into their investment philosophy. With a presence in over 30 countries, Nuveen Real Estate plays a critical role in shaping the built environment across the globe.

Core Strategies of Nuveen Real Estate

Diversification Across Sectors

Nuveen Real Estate invests in multiple sectors to balance risk and capture growth opportunities. Their portfolio includes logistics hubs, multifamily housing, urban office spaces, healthcare properties, and retail centers.

This diversification allows Nuveen to mitigate exposure to downturns in a single sector while benefiting from long-term trends such as e-commerce growth, urbanization, and aging populations.

Focus on Sustainability

Sustainability is embedded in Nuveen’s investment philosophy. They actively seek opportunities to reduce carbon footprints, improve energy efficiency, and invest in green-certified buildings. By aligning with global ESG standards, Nuveen positions itself as a leader in sustainable real estate investment.

The Role of Technology in Nuveen Real Estate’s Strategy

Data-Driven Investment Decisions

Nuveen leverages big data analytics to assess property performance, market demand, and risk factors. This enables the firm to make informed investment choices and maximize returns. Predictive models allow them to anticipate future trends such as population growth, infrastructure development, and tenant demand.

Smart Building Technology

In many of its properties, Nuveen incorporates smart building systems that optimize energy use, enhance tenant experiences, and reduce operating costs. These technologies improve property efficiency while meeting environmental and social objectives.

Digital Investor Platforms

Technology is also transforming the way Nuveen engages with investors. Digital platforms provide real-time insights into portfolio performance, market updates, and sustainability metrics. This transparency builds investor trust and strengthens long-term relationships.

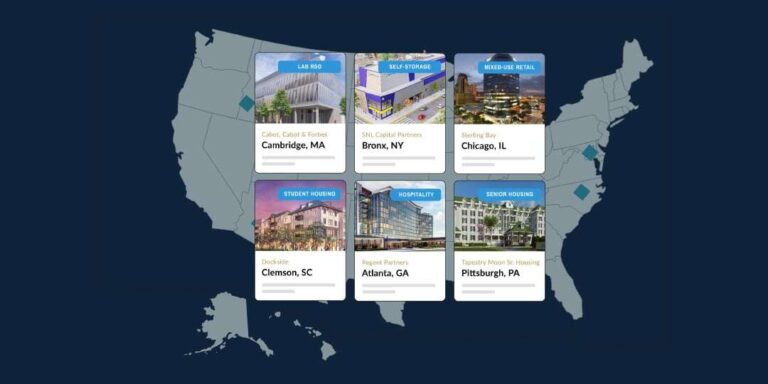

Real-World Examples of Nuveen Real Estate Investments

European Logistics Portfolio

Nuveen Real Estate has built a strong portfolio in the European logistics sector. With the rapid rise of e-commerce, demand for warehouses and distribution hubs has grown significantly. Nuveen has invested in strategically located logistics properties near major cities and transport corridors.

This investment is relevant because it demonstrates how Nuveen adapts to macroeconomic shifts like online shopping, ensuring long-term growth potential while serving essential supply chain needs.

U.S. Multifamily Housing

In the United States, Nuveen has invested heavily in multifamily housing developments. These properties cater to middle-income renters in urban and suburban areas. With rising demand for rental housing and affordability challenges for homeownership, multifamily units provide stable rental income and community-oriented living spaces.

The relevance of this example lies in Nuveen’s ability to align with demographic shifts, such as younger generations favoring renting over buying, while addressing housing shortages.

Sustainable Office Spaces in Asia-Pacific

Nuveen Real Estate has expanded into Asia-Pacific markets, investing in sustainable office developments in cities like Tokyo and Sydney. These buildings are designed with green certifications, energy-efficient systems, and modern amenities that attract multinational tenants.

This example highlights Nuveen’s focus on both environmental responsibility and tenant satisfaction, ensuring properties remain competitive in rapidly growing urban economies.

Healthcare and Senior Living Investments

Recognizing demographic changes, Nuveen has invested in healthcare facilities and senior living properties across Europe and North America. These investments address the growing demand for medical care and senior housing as populations age.

This example is highly relevant because it demonstrates how Nuveen not only generates financial returns but also contributes to meeting societal needs.

Benefits of Nuveen Real Estate’s Investment Approach

Long-Term Stability

Real estate is often considered a long-term asset, and Nuveen’s diversified strategy ensures resilience against short-term market fluctuations. Their broad geographic and sector exposure reduces risks tied to local downturns.

Commitment to ESG Goals

By prioritizing sustainability, Nuveen contributes to the global transition toward greener, more efficient buildings. This not only benefits the environment but also meets growing investor demand for responsible investment products.

Institutional Expertise

With decades of experience and access to TIAA’s resources, Nuveen provides investors with professional management and global insights that individual investors may not access on their own.

Use Cases: How Nuveen Real Estate Impacts Different Stakeholders

For Institutional Investors

Pension funds, insurance companies, and endowments benefit from Nuveen’s large-scale, professionally managed portfolios. These investments deliver both steady income and long-term appreciation, aligning with institutional goals.

For Communities

By investing in housing, healthcare, and sustainable office buildings, Nuveen directly impacts local communities. Their projects create jobs, improve living standards, and enhance infrastructure in the regions they serve.

For Tenants

Tenants enjoy higher-quality, energy-efficient properties with modern amenities. Nuveen’s focus on professional management ensures reliable service, better maintenance, and healthier living or working environments.

Challenges Facing Nuveen Real Estate

Market Volatility

Like all investment firms, Nuveen faces risks from economic downturns, rising interest rates, and geopolitical instability. These factors can impact property values and investor returns.

Regulatory Pressures

As governments push for stricter environmental and housing regulations, compliance costs may rise. However, Nuveen’s proactive sustainability strategy positions it well to adapt.

Competition

The global real estate investment landscape is highly competitive. Nuveen must continually innovate and adapt to maintain leadership against other large firms.

The Future of Nuveen Real Estate

Looking ahead, Nuveen Real Estate is expected to expand further into emerging markets, alternative property sectors, and sustainable technologies. Their commitment to ESG principles will likely strengthen, aligning with global climate goals and investor preferences.

With urbanization, digitalization, and demographic shifts driving demand for innovative real estate solutions, Nuveen is poised to remain a key player in shaping the future of property investment worldwide.

Frequently Asked Questions

1. What makes Nuveen Real Estate different from other investment firms?

Nuveen Real Estate stands out for its global scale, diversified strategy, and commitment to ESG principles. It balances financial performance with long-term societal and environmental benefits.

2. Does Nuveen Real Estate only invest in commercial properties?

No, Nuveen invests across multiple sectors, including residential, logistics, office, healthcare, and retail. This diversification enhances stability and growth potential.

3. How does Nuveen Real Estate use technology in its operations?

Nuveen leverages data analytics, smart building systems, and digital investor platforms to optimize investment decisions, property performance, and transparency for investors.