CrowdStreet Minimum Investment: Complete Guide for Real Estate Investors

CrowdStreet has emerged as one of the leading online real estate investing platforms in the United States. Known for providing accredited investors with access to commercial real estate opportunities, CrowdStreet operates on the principle of crowdfunding, where multiple investors pool funds to participate in large-scale property developments.

One of the most frequently asked questions among potential users is about the minimum investment requirement. Understanding CrowdStreet’s minimum investment threshold is essential, as it defines accessibility, risk level, and portfolio diversification for individuals considering entry into the platform. This guide explores every aspect of CrowdStreet’s minimum investment, with in-depth analysis, benefits, and real-world examples.

What is CrowdStreet and How Does It Work?

CrowdStreet is an online marketplace that connects real estate sponsors (developers or operators seeking capital) with accredited investors looking for new opportunities. Unlike traditional real estate investing, where a person must purchase a property outright, CrowdStreet allows smaller portions of ownership through a digital investment process.

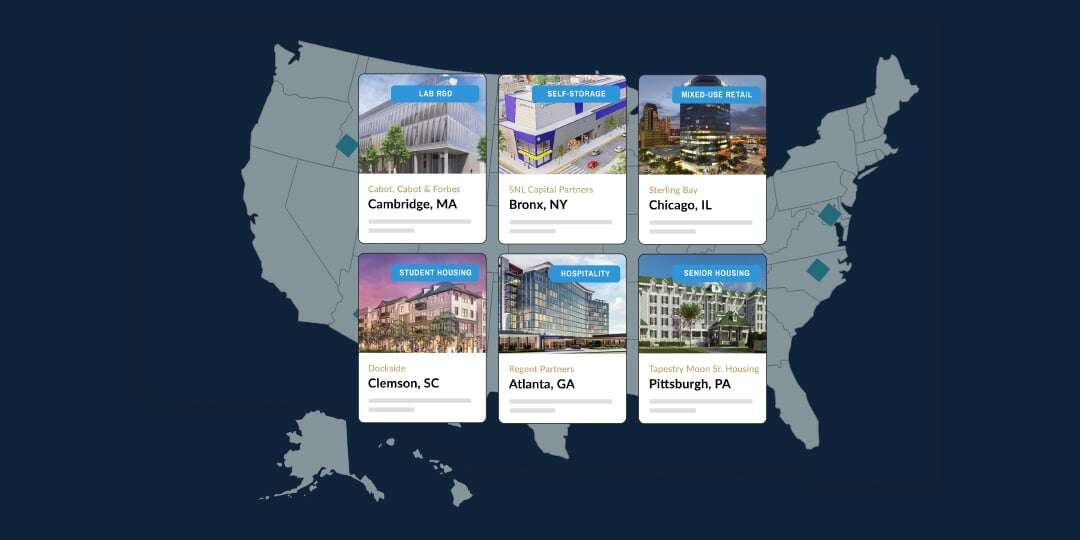

The platform offers several types of opportunities, including single-asset deals, diversified funds, and tailored portfolio services. Each investment has unique terms, including projected returns, hold periods, and—most importantly the minimum investment amount required.

Understanding CrowdStreet Minimum Investment

The minimum investment on CrowdStreet generally ranges between $25,000 and $100,000, depending on the specific deal or fund. While this is higher than some other crowdfunding platforms, CrowdStreet positions itself as a marketplace for serious accredited investors who want exposure to high-quality commercial projects.

The amount you must commit directly influences which deals you can access. Smaller offerings may allow $25,000 as a starting point, while larger institutional-grade projects may demand a higher entry. This system ensures that projects attract investors aligned with the scale and risk of the development.

Why the Minimum Investment Matters

The minimum investment threshold is not just a number; it plays a critical role in how investors approach real estate crowdfunding. For some, $25,000 provides a feasible entry point into commercial real estate, which would otherwise require millions. For others, higher minimums may limit diversification opportunities.

By setting specific thresholds, CrowdStreet balances accessibility with project quality. Investors must carefully evaluate whether the commitment aligns with their liquidity, goals, and long-term wealth-building strategy.

Real-World Examples of CrowdStreet Investments

Multifamily Apartment Development in Texas

A recent project on CrowdStreet offered accredited investors the chance to participate in a Class A multifamily development in Austin, Texas. The minimum investment was $25,000, making it accessible for investors wanting to gain exposure to the booming Texas housing market. This project highlighted how even a relatively modest amount could open doors to institutional-grade real estate previously unavailable to individuals.

The project aimed to deliver returns through rental income and property appreciation, giving participants a direct stake in the region’s population growth and rental demand.

Office Tower Redevelopment in Chicago

Another CrowdStreet deal involved the repositioning of an office tower in downtown Chicago. The minimum investment required was $50,000, reflecting the higher cost and complexity of urban redevelopment. Investors in this deal were given opportunities to benefit from both leasing activity and the appreciation potential of revitalized office space in a prime market.

This example demonstrates how higher minimums often correspond with larger-scale projects offering unique risk-reward profiles.

Healthcare Real Estate Portfolio

CrowdStreet also listed a diversified healthcare property fund with a minimum entry point of $100,000. This was designed for investors seeking broader exposure across multiple assets such as medical offices, assisted living facilities, and specialized care centers.

While the entry point was higher, the built-in diversification provided investors with reduced risk by spreading capital across several properties. This use case illustrates how CrowdStreet accommodates both smaller and larger investors depending on their financial capacity and strategic goals.

Benefits of CrowdStreet Minimum Investment Structure

The tiered structure of CrowdStreet’s minimum investment offers practical benefits for investors who want to balance risk, returns, and accessibility.

First, it democratizes access to commercial real estate. Before platforms like CrowdStreet, participating in institutional-grade real estate deals required millions of dollars. Now, with entry points starting at $25,000, more investors can diversify beyond traditional stocks and bonds.

Second, the minimum investment helps maintain deal quality. By requiring substantial commitments, CrowdStreet attracts investors who are serious about long-term outcomes, which aligns sponsor and investor incentives. This ensures higher accountability in project execution.

How Technology Enhances the Investment Experience

CrowdStreet leverages advanced technology to streamline the real estate investing process. From digital dashboards to detailed performance tracking, technology plays a key role in transparency and accessibility. Investors can review documents, project updates, and financial models directly from their accounts, making decision-making far more efficient than traditional methods.

For minimum investment considerations, technology allows CrowdStreet to segment opportunities and ensure clear communication of terms. This prevents misunderstandings and empowers investors with detailed data before committing capital.

Use Cases of CrowdStreet Minimum Investment

CrowdStreet’s minimum investment structure can solve several real-world problems faced by modern investors:

-

Portfolio Diversification: Instead of concentrating wealth in one property, an investor can allocate $25,000–$50,000 across multiple deals, reducing risk.

-

Access to Premium Real Estate: Investors gain entry to commercial-grade assets such as hotels, office towers, or multifamily complexes without direct ownership costs.

-

Wealth Building for Professionals: Accredited investors with disposable capital can grow wealth passively while focusing on careers or businesses.

-

Geographic Reach: Minimum investment thresholds allow investors to access markets across the U.S., mitigating risks tied to local economic downturns.

Challenges of the Minimum Investment

While beneficial, the minimum investment requirement also presents challenges. For smaller investors, $25,000 may still be a significant barrier. Additionally, the illiquid nature of real estate means funds are tied up for years, requiring careful planning.

These challenges underline the importance of evaluating personal financial circumstances before entering CrowdStreet deals. The platform is designed for those with the financial capacity to withstand long-term commitments without affecting short-term liquidity.

Conclusion

The CrowdStreet minimum investment represents a pivotal aspect of real estate crowdfunding. It defines accessibility, risk level, and investor alignment in large-scale projects. Whether at $25,000, $50,000, or $100,000, the threshold ensures that participants are serious, while still lowering barriers compared to direct real estate ownership.

For accredited investors seeking exposure to premium commercial real estate, CrowdStreet provides an innovative gateway. By understanding the nuances of its minimum investment requirements, investors can make more informed decisions aligned with their goals.

FAQ

1. What is the typical minimum investment on CrowdStreet?

Most deals on CrowdStreet have a minimum investment ranging from $25,000 to $100,000, depending on the size and type of project.

2. Why is the minimum investment higher than on other crowdfunding platforms?

CrowdStreet focuses on institutional-quality projects. Higher minimums ensure that investors are financially prepared for the risks and long-term commitments.

3. Can I diversify with CrowdStreet if the minimum is $25,000?

Yes. Investors can spread multiple $25,000 allocations across different projects or funds to diversify risk and create a balanced portfolio.