Cash Buyer Investors: Complete Guide to Real Estate Transactions in 2025

Cash buyer investors are individuals or entities who purchase properties outright without the need for traditional mortgage financing. In real estate, these buyers hold significant power because their ability to transact quickly makes them highly attractive to sellers. They can close deals faster, avoid many bureaucratic steps, and bring certainty to transactions in a way that financed buyers often cannot.

Understanding cash buyer investors is crucial not only for sellers but also for real estate professionals and even communities. Their activities influence housing availability, pricing trends, and the competitive landscape for both residential and commercial properties.

Who Are Cash Buyer Investors?

Cash buyer investors typically fall into several categories: seasoned real estate professionals, private equity firms, institutional investors, and high-net-worth individuals. Their primary focus is on acquiring properties for various investment strategies, whether it’s flipping, renting, or long-term portfolio diversification.

What distinguishes them is their liquid capital. Unlike traditional buyers who depend on lenders, cash buyer investors are self-funded. This independence from banks makes their transactions quicker and less risky, which in turn allows them to negotiate more favorable terms in many markets.

Why Cash Buyer Investors Are Influential in Real Estate

One of the most important aspects of cash buyer investors is the speed they bring to transactions. While financed deals can take weeks or even months to close, cash buyers can often finalize purchases within days. This speed is highly appealing to sellers who need liquidity quickly, such as homeowners facing foreclosure or estates that need fast settlement.

Additionally, cash buyer investors reduce the risk of deals falling through. Since they do not rely on lenders, they eliminate contingencies tied to financing approvals. This certainty makes them a preferred choice in competitive housing markets.

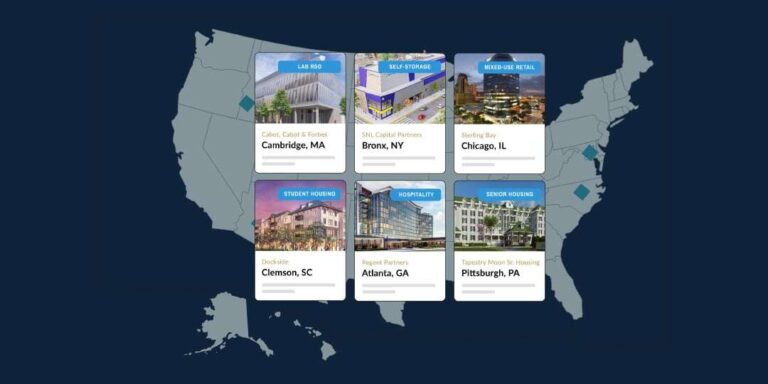

Real-World Examples of Cash Buyer Investors

1. Institutional Real Estate Funds

Large real estate funds are increasingly active as cash buyer investors. For example, investment firms may purchase entire neighborhoods of single-family homes to convert them into rental properties. This strategy not only provides stable income streams but also shapes the rental market for middle-income households. Their scale of operation demonstrates how cash buyer investors can impact local housing affordability and availability.

2. House-Flipping Companies

Companies specializing in house flipping are classic examples of cash buyer investors. They acquire distressed properties below market value, invest in renovations, and sell them at a profit. Their reliance on cash allows them to act quickly when opportunities arise, especially in competitive foreclosure markets. This business model has fueled much of the visibility around cash buyer activity in recent years.

3. High-Net-Worth Individual Investors

Many wealthy individuals also act as cash buyer investors, purchasing properties for long-term appreciation or as secondary residences. Their flexibility gives them access to high-demand areas where traditional buyers may struggle to compete. For example, luxury vacation destinations often see strong activity from these buyers, which can influence pricing trends in those markets.

4. iBuyers (Instant Buyers)

iBuyers represent a technology-driven category of cash buyer investors. Platforms like these use algorithms to assess property values and make instant cash offers to homeowners. While relatively new, iBuyers have disrupted the traditional real estate process by offering convenience, speed, and certainty. They are particularly relevant in suburban and urban areas where homeowners seek faster, tech-enabled solutions to sell properties.

Benefits of Technology for Cash Buyer Investors

Technology has transformed the landscape for cash buyer investors in recent years. Data analytics tools allow them to evaluate market trends with precision, identifying profitable opportunities that align with their investment goals. Platforms for digital property management streamline operations, enabling investors to scale efficiently across multiple locations.

Additionally, virtual tours, blockchain-based smart contracts, and AI-powered valuation tools further accelerate the buying process. These advancements minimize risks and increase transaction transparency, creating a more efficient marketplace for both investors and sellers.

Practical Advantages of Cash Buyer Investors

The presence of cash buyer investors provides multiple benefits in real-world scenarios. For sellers, the key advantage lies in reduced uncertainty and faster access to capital. For communities, these investors often renovate and repurpose neglected properties, which contributes to neighborhood revitalization.

Moreover, for real estate markets as a whole, cash buyer investors bring liquidity and stability. Even during downturns, their presence ensures that transactions continue to flow, helping to support property values and prevent stagnation.

Use Cases: How Cash Buyer Investors Solve Real Problems

Distressed Property Owners

Cash buyer investors offer a lifeline to homeowners facing foreclosure, bankruptcy, or urgent relocation. By providing immediate liquidity, they allow these sellers to exit difficult financial situations without enduring long waiting periods.

Estate Sales

When heirs inherit properties, they may need quick resolutions. Cash buyer investors simplify this process by purchasing properties outright, saving families from lengthy listing processes or disputes over sales timelines.

Competitive Housing Markets

In fast-moving markets, cash buyers are often the only realistic option for sellers seeking certainty. For instance, in cities experiencing rapid population growth, financed offers may be overshadowed by cash buyer investors who can guarantee closure within days.

Challenges and Criticisms of Property Cash Buyers

Despite their advantages, cash buyer investors also face criticisms. Their activity can drive up property prices, making it harder for traditional buyers to compete. This issue is especially pronounced in markets where large institutional investors dominate residential purchases.

Additionally, some communities worry about the long-term impacts when significant portions of housing stock are controlled by investors rather than owner-occupiers. These concerns highlight the need for balance and thoughtful regulation to ensure healthy housing markets.

Conclusion

Property cash buyers have become a defining force in modern real estate markets. By offering speed, certainty, and capital flexibility, they provide unique advantages to sellers and communities. Whether they are institutional funds, flippers, high-net-worth individuals, or tech-driven iBuyers, their role will continue to evolve alongside technological innovations and market dynamics.

For real estate professionals and homeowners alike, understanding Property cash buyers is essential to navigating the competitive landscape of property transactions in 2025.

Frequently Asked Questions

What is the main advantage of cash buyer investors for sellers?

The biggest advantage is speed and certainty. Sellers avoid the delays and risks tied to mortgage financing, often closing deals within days.

Do cash buyer investors only focus on distressed properties?

No. While many target distressed homes for flipping, others invest in luxury residences, rental portfolios, and long-term appreciation opportunities.

How do Property cash buyers impact housing affordability?

Their influence varies. In some cases, they help stabilize markets by buying unsold homes. In others, especially when institutional investors dominate, they can contribute to rising prices and reduced availability for traditional buyers.