BlackRock Buying Houses: Understanding the Trend and Its Market Impact

The phrase BlackRock buying houses has gained attention worldwide as the investment giant expands into residential real estate. Known primarily for managing trillions in global assets, BlackRock’s move into homeownership has sparked debates about affordability, housing availability, and the growing influence of financial institutions in everyday life.

While the idea of a global asset manager purchasing single-family homes might seem unusual, it reflects broader trends in the housing market. Institutional investors have increasingly viewed real estate not just as a hedge against inflation but as a long-term growth sector with steady returns.

Why BlackRock Is Buying Houses

BlackRock’s interest in residential real estate stems from the stability of housing as an asset class. Unlike volatile stocks, residential properties generate consistent rental income and appreciate steadily over time. For an asset manager responsible for pensions, endowments, and retirement accounts, this predictability is appealing.

Additionally, the COVID-19 pandemic accelerated demand for suburban homes, creating opportunities for large-scale buyers. BlackRock, with its vast capital resources, is well-positioned to acquire homes in bulk, renovate them, and generate income streams through rentals.

How BlackRock Buys Properties

Institutional investors like BlackRock typically acquire homes in two main ways: bulk purchases from developers or direct acquisitions of single-family units on the market. By buying multiple properties at once, they can secure lower prices and reduce acquisition costs.

These homes are often renovated and then rented out under professional property management. This approach allows BlackRock to diversify its real estate portfolio while contributing to the growing rental housing market.

Real-World Examples of BlackRock’s Housing Investments

Suburban Single-Family Rentals

BlackRock has been active in acquiring single-family homes in suburban areas across the U.S. These properties often target growing metro regions where demand for rentals is high. By holding these homes, BlackRock creates long-term revenue streams while benefiting from property appreciation.

The relevance here lies in meeting the increasing demand for suburban rentals, particularly from families priced out of homeownership. This investment strategy aligns with demographic shifts toward suburban living.

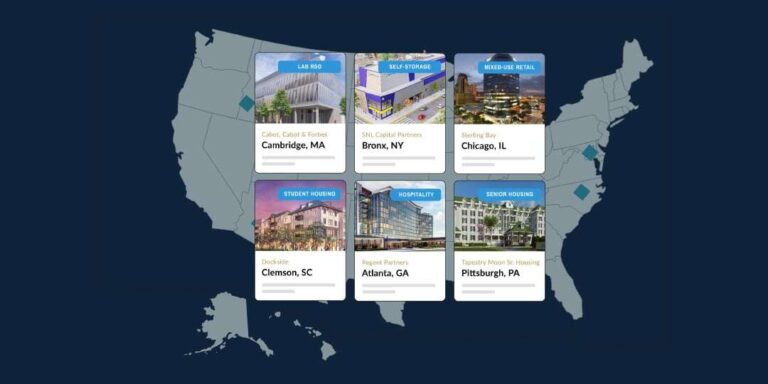

Partnerships with Real Estate Platforms

Rather than managing every acquisition independently, BlackRock has partnered with established real estate platforms and developers. These partnerships allow them to scale faster and manage larger portfolios efficiently.

Such collaborations highlight the role of technology and local expertise in institutional real estate. By leveraging these partnerships, BlackRock ensures that its investments are strategically located and well-managed.

Urban Multifamily Investments

While suburban single-family homes attract much attention, BlackRock has also invested in multifamily complexes in urban centers. These investments cater to young professionals, students, and city dwellers who prefer renting over ownership.

By diversifying into multifamily housing, BlackRock reduces risk and addresses different segments of the rental market. This ensures long-term stability and meets the housing demand of urban populations.

Renovation and Value-Add Properties

Another key strategy involves acquiring older or distressed properties, renovating them, and renting them at market rates. This not only improves housing quality but also revitalizes neighborhoods.

The value-add approach is particularly significant in cities with an aging housing stock. It allows BlackRock to create competitive rental units while enhancing community aesthetics and infrastructure.

The Role of Technology in BlackRock’s Housing Investments

Technology plays a central role in BlackRock’s real estate strategy. Data analytics platforms help identify high-growth markets, forecast rental demand, and optimize acquisition timing. This ensures that each property purchase aligns with long-term profitability goals.

Furthermore, property management technology streamlines tenant communication, rent collection, and maintenance requests. These digital solutions reduce overhead and improve tenant satisfaction, ensuring sustainable returns.

Artificial intelligence enhances investment decisions by predicting future housing trends. For a firm like BlackRock, AI-driven insights can determine where to allocate billions of dollars for maximum impact.

Benefits of BlackRock Buying Houses

One of the primary benefits of institutional investment in housing is increased professionalism in property management. Large firms bring resources to maintain properties, ensure compliance, and provide consistent rental experiences for tenants.

Additionally, BlackRock’s investments inject capital into housing markets, revitalizing older neighborhoods and creating modern rental opportunities. This contributes to local economies by generating construction, renovation, and maintenance jobs.

For investors, residential real estate offers a hedge against inflation and a steady source of income. For communities, it can mean improved housing quality and increased rental options.

Use Cases of Institutional Housing Investments

Expanding Rental Housing Supply

By acquiring and managing homes, BlackRock increases the supply of rental housing. This benefits families who cannot afford homeownership or prefer the flexibility of renting.

Revitalizing Aging Housing Stock

Through renovation investments, older properties are upgraded, enhancing neighborhood appeal and providing safer, more modern homes for residents.

Supporting Community Development

Large-scale housing investments create ripple effects across communities. From hiring local contractors to boosting property values, these activities stimulate economic growth.

Criticisms and Challenges of BlackRock Buying Houses

Despite its benefits, BlackRock’s role in housing markets has sparked criticism. Some argue that institutional investors drive up home prices, making ownership harder for first-time buyers. The concern is that competing with a trillion-dollar asset manager tilts the market against ordinary families.

Additionally, concentrating housing ownership in the hands of large firms raises questions about affordability, tenant rights, and long-term community impact. Policymakers continue to debate whether regulations should limit institutional ownership of residential properties.

Frequently Asked Questions

1. Why is BlackRock buying houses instead of other assets?

BlackRock views residential real estate as a stable investment with consistent returns. Homes provide steady rental income and long-term appreciation, making them attractive compared to volatile financial markets.

2. Does BlackRock’s buying affect home affordability?

Critics argue that institutional investors can drive up prices in competitive markets, limiting access for first-time buyers. However, supporters highlight the role of these investments in expanding rental housing and improving property quality.

3. How does technology help BlackRock manage housing investments?

Technology enables efficient acquisition analysis, predictive market insights, and streamlined property management. Digital platforms ensure cost savings and improved tenant experiences across large property portfolios.