Residential Real Estate Appraisals: Complete Guide to Value, Technology, and Use Cases

Residential real estate appraisals are at the core of every property transaction, from home sales to mortgage approvals. They provide an unbiased estimate of a property’s fair market value, ensuring buyers, sellers, and lenders make informed decisions.

An appraisal is more than just a number; it reflects the interplay between location, condition, market dynamics, and future potential. For homeowners, it offers clarity on pricing; for buyers, it ensures fairness; and for financial institutions, it provides security for lending decisions. Understanding how appraisals work is essential for anyone engaged in the real estate market.

What Are Residential Real Estate Appraisals?

At their foundation, residential real estate appraisals are professional evaluations of a property’s worth. Licensed appraisers carry out this process by inspecting the property, analyzing market data, and comparing it with similar homes recently sold in the area.

These appraisals are critical in transactions where financing is involved. Banks rely on them to confirm that the property’s value supports the requested mortgage amount. Buyers and sellers also use appraisals to ensure that asking prices are realistic in line with market conditions.

Sample Property Appraisal Report

Appraisal reports are structured documents containing details such as property description, photographs, recent comparable sales, and adjustments made to determine the final value.

Such reports act as official records that protect all parties in a transaction. They bring transparency, reduce disputes, and support smooth financial processes. For lenders, these reports are indispensable for reducing the risks of loan defaults.

Key Factors That Influence Residential Real Estate Appraisals

Several elements come together to shape the outcome of an appraisal:

-

Location: Properties near schools, shopping centers, transport hubs, and employment opportunities usually command higher values.

-

Size and Layout: Square footage, number of bedrooms, and functional design all influence the final estimate.

-

Condition and Age: Well-maintained, modern properties typically appraise higher than older homes requiring repairs.

-

Market Trends: Broader real estate market conditions, such as supply, demand, and interest rates, significantly affect appraisals.

-

Unique Features: Pools, landscaped gardens, energy-efficient upgrades, or smart home systems can increase property value.

These factors demonstrate that appraisals are comprehensive, going beyond surface-level assessments to reflect real market dynamics.

Importance of Residential Real Estate Appraisals

Appraisals ensure fairness in the real estate market.

-

Homeowners gain reassurance knowing that a property’s asking price is competitive.

-

Buyers benefit from protection against overpaying.

-

Meanwhile, lenders view appraisals as collateral validation, ensuring that loan amounts are properly secured.

Without accurate appraisals, transactions could result in disputes, financial losses, or risky loans. They are, therefore, a cornerstone of trust in the property sector, balancing the interests of all stakeholders involved.

On-Site Property Inspection

On-site inspections are a crucial part of the appraisal process. Appraisers evaluate structural integrity, assess recent renovations, and take note of upgrades that may add value.

For example, an energy-efficient HVAC system or solar panels may positively impact valuation. By combining visual inspection with data-driven analysis, appraisers ensure their reports reflect both physical condition and market realities.

Benefits of Using Technology in Residential Real Estate Appraisals

Technology is reshaping the appraisal landscape, making processes faster, more accurate, and more transparent.

-

AI-Powered Valuation Tools: Artificial intelligence analyzes thousands of variables simultaneously, providing highly accurate property value predictions.

-

Big Data Analytics: With access to comprehensive datasets, appraisers can identify neighborhood trends, pricing patterns, and future growth potential.

-

Drones and 3D Imaging: These tools capture aerial and interior details, offering unique perspectives that strengthen valuation accuracy.

-

Blockchain Integration: Secure, tamper-proof valuation records increase trust and transparency in real estate transactions.

By embracing these technologies, appraisers are able to deliver results that align with modern real estate demands while saving time for both clients and institutions.

Real-World Examples of Residential Real Estate Appraisals

AI Valuation Software

Modern appraisal firms increasingly rely on AI-based software that cross-references local sales data, property features, and economic indicators.

This ensures faster turnaround times and more precise valuations, which are especially valuable in competitive housing markets where timing is crucial. Both lenders and buyers benefit from the enhanced accuracy these tools provide.

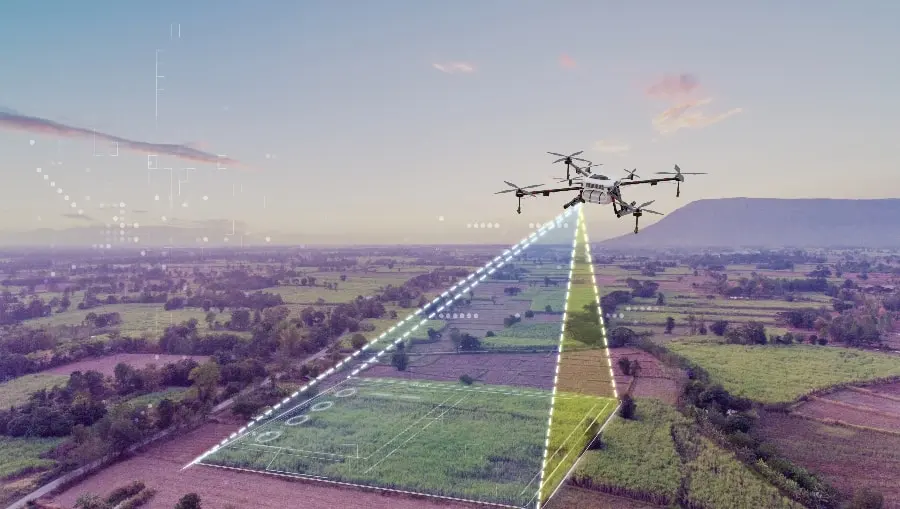

Drone-Assisted Property Appraisals

Drones provide aerial images that highlight features such as property boundaries, landscaping, and neighborhood infrastructure.

For suburban and rural properties, where land size and surroundings matter significantly, drone imagery adds an extra layer of precision. This approach not only enhances accuracy but also increases buyer confidence.

Blockchain-Based Valuation Records

Blockchain technology ensures that appraisal data is secure, transparent, and immutable.

For financial institutions, this reduces fraud risks and simplifies compliance checks. For buyers and sellers, it guarantees the credibility of appraisal reports, making transactions more trustworthy and efficient.

Virtual Reality Inspections

Some appraisers now use VR technology to conduct virtual walkthroughs of properties.

This is particularly useful for buyers and investors located overseas, enabling them to explore properties remotely while still receiving accurate valuation data. It expands accessibility and enhances decision-making for global real estate markets.

Practical Benefits of Residential Real Estate Appraisals

Accurate appraisals benefit multiple stakeholders:

-

Homeowners: Gain insight into true market value, aiding in pricing decisions and equity assessments.

-

Buyers: Receive protection against overpaying for a property, ensuring long-term financial security.

-

Investors: Use appraisals to analyze potential returns and portfolio growth opportunities.

-

Lenders: Minimize lending risks by securing loans with accurate property values.

These benefits demonstrate why appraisals are more than a regulatory requirement—they are a practical necessity in real estate.

Use Cases of Residential Real Estate Appraisals

Use Case 1: Mortgage Loan Approvals

Banks require appraisals to confirm that the collateral (the property) matches the loan amount. This reduces financial risks for both lenders and borrowers.

Use Case 2: Home Selling Strategy

Homeowners use appraisals to set realistic listing prices, helping properties sell faster and avoiding overpricing, which can delay transactions.

Use Case 3: Property Tax Assessment

Accurate appraisals ensure that homeowners are not overpaying property taxes while municipalities collect fair revenue.

Use Case 4: Estate Planning and Divorce Settlements

Appraisals provide objective property valuations, ensuring fairness during inheritance distributions or divorce proceedings.

These real-world scenarios highlight the indispensable role of appraisals in protecting interests and supporting sound decision-making.

Frequently Asked Questions

1. What is the difference between a real estate appraisal and a home inspection?

A real estate appraisal estimates property value, while a home inspection evaluates the property’s condition. Both are important, but serve different purposes.

2. How long is a residential real estate appraisal valid?

Typically, appraisals remain valid for 90 to 180 days, depending on market conditions. In volatile markets, validity may be shorter.

3. Can homeowners increase their appraisal value?

Yes. Renovations, upgrades, and proper maintenance can positively impact an appraisal, though location and market trends remain the most influential factors.