Residential Valuation Services: Complete Guide for Accurate Property Assessment

Residential valuation services are a cornerstone of the real estate industry, helping homeowners, buyers, investors, and lenders determine the true market value of a property. Whether you are preparing to sell, buy, refinance, or invest, an accurate valuation ensures transparency, financial stability, and better decision-making.

In this article, we will explore the full scope of residential valuation services, their role in the real estate sector, the impact of modern technology, and real-world examples that showcase their importance.

What Are Residential Valuation Services?

Residential valuation services refer to the process of determining the market value of a residential property based on factors such as location, condition, size, demand, and market trends. These services are usually performed by certified appraisers or valuation professionals.

The goal is to provide an objective, data-backed estimate of a property’s worth, which is essential for transactions like buying, selling, refinancing, or tax purposes. Accurate valuations protect both buyers and sellers from making financial decisions based on inflated or underestimated property values.

Why Residential Valuation Services Are Essential

Property valuation is more than just a financial exercise; it is a safeguard for fair transactions. For sellers, a valuation prevents undervaluing their asset. For buyers, it ensures they do not overpay. Lenders rely on valuations before approving mortgage loans, while investors use them to assess profitability.

By establishing a reliable market value, residential valuation services create confidence and reduce disputes. They provide clarity in negotiations and help in long-term planning for property owners.

Key Components of Residential Valuation

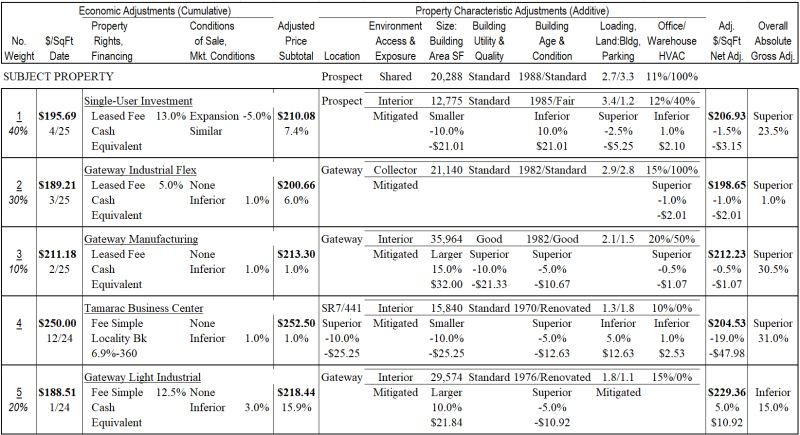

Market Analysis

A comprehensive market analysis compares the subject property with similar properties recently sold in the area. This method ensures that the valuation reflects real-time market demand and pricing.

Property Inspection

A physical inspection evaluates structural integrity, design, amenities, and condition. This allows appraisers to determine how the property stacks up against others in its segment.

Neighborhood Evaluation

Location remains a dominant factor in property valuation. Appraisers examine proximity to schools, transportation, parks, and commercial areas, all of which impact desirability.

The Role of Technology in Residential Valuation Services

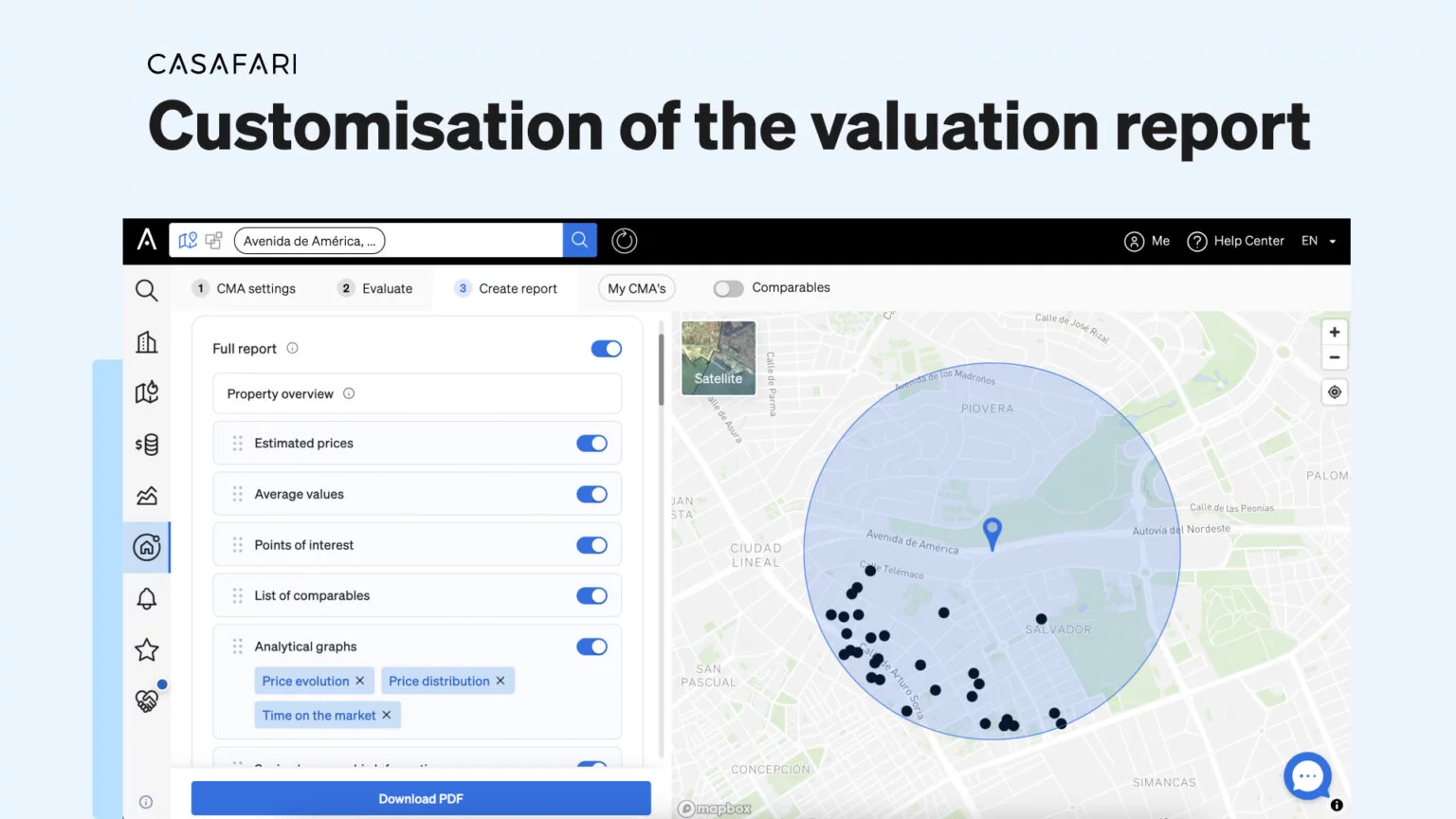

Technology has significantly reshaped residential valuation services, making them faster, more accurate, and accessible. Digital tools, big data, and AI algorithms now supplement traditional appraisal methods.

Automated Valuation Models (AVMs), for instance, use large datasets of property transactions and trends to generate instant property valuations. While they do not replace in-person appraisals entirely, they provide a useful baseline.

Additionally, 3D property scans, drone photography, and AI-powered market forecasting enable appraisers to analyze properties with precision, ensuring fewer discrepancies and more accurate pricing.

Real-World Examples of Residential Valuation Services

Example 1: CoreLogic Valuation Solutions

CoreLogic offers advanced valuation tools that integrate with big data analytics. Their platform helps lenders, investors, and appraisers assess property values with high accuracy. The service leverages Automated Valuation Models combined with on-the-ground appraiser expertise, ensuring balanced results.

The relevance of CoreLogic lies in its ability to provide lenders with confidence when approving loans, minimizing risks of over-lending or undervaluation.

Example 2: HouseCanary Valuation Technology

HouseCanary is a real estate technology company specializing in predictive property valuations. Their system combines AI, machine learning, and a massive dataset of U.S. property records.

This example demonstrates how residential valuation services can move beyond static appraisals to dynamic forecasting. Investors, in particular, benefit from projections about future property values, which inform long-term portfolio strategies.

Example 3: Zillow Zestimate Tool

Zillow’s Zestimate is widely known for offering quick online property estimates. While not a substitute for professional appraisals, it highlights how valuation services have become mainstream for homeowners curious about their property value.

The tool’s relevance lies in its accessibility. Homeowners can use it as a starting point before contacting professionals, bridging the gap between casual interest and formal valuation.

Example 4: Appraisal Institute Standards

The Appraisal Institute provides professional valuation services based on globally recognized standards. Their certified appraisers follow rigorous methodologies to ensure accurate and unbiased property evaluations.

The relevance here is trust and credibility. Institutional clients, governments, and financial entities rely on such organizations to ensure valuations are legally compliant and defensible in court or financial audits.

Practical Benefits of Residential Valuation Services

Accurate residential valuation services provide a range of benefits for stakeholders in the real estate sector:

-

For Homeowners: Ensures fair pricing when selling or refinancing.

-

For Buyers: Prevents overpaying for a property by providing a realistic price point.

-

For Lenders: Minimizes risks by confirming that the loan amount aligns with the property value.

-

For Investors: Informs investment strategies with reliable forecasts and assessments.

Beyond financial protection, valuations build trust between parties, reduce disputes, and create a smoother path for negotiations.

Use Cases of Residential Valuation Services

Selling a Property

Sellers often rely on valuations to set realistic listing prices. Without them, properties may linger on the market if overpriced or sell too quickly at a loss if undervalued.

Refinancing a Mortgage

Lenders require updated valuations before approving refinancing. This ensures the loan amount reflects the property’s current value and protects both lender and borrower.

Inheritance and Estate Planning

Residential valuation services play a critical role in estate settlements, inheritance disputes, and tax assessments. Accurate appraisals ensure fair distribution and compliance with legal requirements.

Property Tax Appeals

Homeowners can use professional valuations to dispute unfair tax assessments. This ensures they pay only what is fair, based on current market conditions.

Future of Residential Valuation Services

The future of valuation lies in combining human expertise with advanced technology. Appraisers will continue to provide nuanced, context-rich insights, while AI and big data will support them with speed and predictive accuracy.

With global trends like sustainability and smart homes influencing property values, valuation services will need to adapt by factoring in energy efficiency, renewable energy integration, and technological upgrades as part of property worth.

Frequently Asked Questions

1. What is the difference between a residential valuation and an appraisal?

Both terms are often used interchangeably, but appraisals are typically more formal and used for legal or lending purposes, while valuations can be broader and include market assessments or online tools.

2. How often should I get my residential property valued?

It depends on your purpose. If you’re refinancing or selling, you’ll need an updated valuation. In general, every 1–3 years is recommended to stay aligned with market conditions.

3. Are online valuation tools accurate enough to replace professional appraisals?

Online tools like Zestimate or AVMs provide a quick estimate but lack the nuance of a professional appraisal. They are best used as starting points rather than final valuations.